What is the DECC Aviation Plan for Wind Turbines?

The UK Department for Energy and Climate Change (DECC) has produced a document [1] regarding the continued development of wind turbines within the UK, where aviation constraints are significant. The purpose of the document is to:

…develop and enable the implementation of mitigation measures to reduce the impacts of wind turbines on radar and aviation to acceptable levels, whilst taking all necessary steps to protect the safety of civilian and military air operations.

The Players

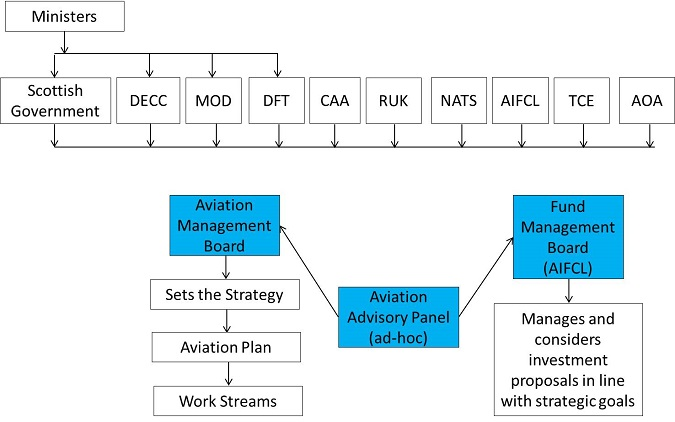

The governing structures listed within the document are:

- The Aviation Management Board – which has the overall responsibility of delivery of the Aviation Plan and its agreed programs of work.

- The Aviation Advisory Panel – which supports the Aviation Plan by bringing together relevant expertise.

- The Fund Management Board – which is the decision making board of Directors for the Aviation Investment Fund Company Limited (established under the Aviation Memorandum of Understanding signed in 2008, its formation was led by Renewable UK).

- There are numerous other organisations that are important to the development of wind energy. The Aviation Plan shows a flow-chart in an appendix, this is reproduced below:

Figure 1: Governance Flow Chart.

The Issues

The document gives a summary of the biggest aviation issues facing wind developments in the UK. The key points are set out below.

- Air Defence Radar – The MOD signed the first Contribution Agreement with wind developers in June of 2011. This was for the Air Defence radar upgrade at Trimingham. Further upgrades at Staxton Wold and Brizlee Wood have been funded by developers via contribution agreements. An agreement has been signed for the radar at Buchan in Scotland as well, and commissioning of the radar and trials assessing their performance are ongoing.

- NATS En-Route Radar – Raytheon was commissioned to research and develop a radar modification package for the NATS En-Route radar, the findings have been taken forward by NATS who are offering a commercial solution for the Great Dun Fell radar and the Lowther Hill radar. NATS estimates that up to 2GW of new wind capacity could be released.

- Eskdalemuir Seismology Array – New research in 2013 led to a new methodology for calculating wind turbine seismic ground vibrations. This methodology has been adopted by the MOD and has led to the removal of a significant onshore wind deployment barrier. Further details are not provided within the DECC report however it refers readers to the Scottish Government for more information [2].

Upcoming Tasks

The DECC document acknowledges that while progress has been made there is no single mitigation solution that addresses all aviation issues. It specifically mentions the challenges relating to air traffic control primary surveillance radar. Trials were undertaken in the summer of 2013 by the MOD to evaluate a number of solutions. The report states that:

‘…whilst more than one technology showed an improvement over the baseline performance of MOD’s unmodified ATC radar, none fully met MOD’s assessment criteria.’

The MOD proposes continuing the process by taking the recommendations of the technology assessment forward (the report does not disclose what these recommendations were) subject to wind industry funding.

The DECC document goes on to mention the upcoming Spectrum Release programme (more can be read about this here). The plan is to release 500 MHz of spectrum from public infrastructure use by 2020. One of the benefits of this release is the potential to develop a strategic approach to wind farm mitigation.

What Happens Next?

The DECC has set out a work stream for the various tasks going forward, followed by proposed milestones. The entire schedule is not reproduced here, however the task owners and a brief overview of their responsibilities is given below.

- MOD – owns tasks relating to:

- A ‘Technology Pilot’ in order to identify a technical solution (this is to be funded by the wind industry). An application process, funding and a ‘next steps’ milestone plan is due to be completed by March 2015.

- Air Defence Radar Capacity/Upgrades. A capacity increase is due to be completed by December 2015.

- Exploring the potential for mitigation of Precision Approach Radar issues. Engagement with the PAR manufacturer to explore mitigation is due to be completed by March 2015.

- CAA – owns tasks relating to:

- Spectrum Release. The outcome of the first trials was due January 2015. The Go/No‑Go decision for continuation of studies is due March 2015.

- Further research regarding turbulence. Development of guidelines is due by March 2015. Publication of guidelines in CAP 764 is due by September 2015.

- Improving understanding of issues wind turbines cause to aircraft voice communications (NATS is co-owner of this task). Various work packages have deadlines between September 2015 and March of 2016.

- NATS – owns tasks relating to:

- Extending the roll-out of Project RM. Deadlines for interest in radar upgrades at Claxby is March 2015. The Great Dun Fell upgrade is due by September 2015. The Lowther Hill upgrade is due by March 2016.

- Improving understanding of issues wind turbines cause to aircraft voice communications (the CAA is co-owner of this task). Various work packages have deadlines between September 2015 and March of 2016.

- RUK – owns tasks relating to:

- Offshore Aviation Operations (The Crown Estate is the co-owner of this task). The Offshore Aviation Operations Group is to assist in developing agreed work and producing guidelines by June of 2015.

- Collecting evidence to assess and understand the scale of the problem [3] (DECC is the co-owner of this task). An RUK Members Survey preparation and design was due in February 2015. The trawl for responses is due by March 2015. Analysis and first impressions draft is due by April of 2015 and a report to AMB is due by June of 2015.

- DECC – owns a task relating to:

- Collecting evidence to assess and understand the scale of the problem [3] (RUK is the co-owner of this task, see above).

- Scottish Government – owns a tasks relating to:

- The Scottish Wind Farm and Aviation Group, a forum allowing more focus on Scottish aviation issues.

Summary

The DECC report acknowledges that progress has been made, but challenges remain. The next steps largely relate to conducting further research and trials relating to issues and solutions that are already on the wind energy scene.

The important players have commitments to tasks designed to lead to solutions. However, a revolutionary step forward for mitigation remains elusive.

Footnotes

[3] ‘The problem’ is not defined however this is understood to relate to aviation issues in general

Image accreditation: Replica of the flowchart given in Annex A on p13 of The Aviation Plan: 2015 Update, DECC.

References

[1] The Aviation Plan: 2015 Update, DECC (Last accessed 18/03/15).

[2] Energy Consents – Guidance, The Scottish Government (Last accessed 18/03/2015).