Background

Governments tax things that are bad for us. This reduces the amount we do bad things and gives money to the government to do good things. Classic examples are taxes on cigarettes and vodka as well as London’s congestion charge.

To my mind taxing carbon emissions has always seemed a no-brainer. Why tax good things like employment when you can tax bad things like carbon emissions? In this article I consider:

- The theoretical benefits of carbon taxes

- Why carbon taxes have not really been established yet

- Why this might be about to change

- Realistic carbon tax rates

Benefits of Carbon Taxes

Microeconomic theory relies on markets to drive our behaviours including what we make, what we buy and where we choose to work. Some activities cause adverse effects to the wider community (referred to as social costs). Efficient markets do not account for the additional social costs thus making the market inefficient. Taxes (known as Pirougian taxes) may be used to correct such market inefficiencies.

A carbon tax would make the emitting carbon dioxide more expensive and would encourage changes in behaviour that would reduce emissions. The market would encourage technologies and activities that would create the largest savings for the least cost – arguably more efficient than having government direct and regulate insulation projects and setting renewable energy targets.

Carbon taxes theoretically have the potential to reduce worldwide carbon emissions and minimize any adverse effects on the economy.

Why no Carbon Taxes yet?

There are many reasons. The main ones seem to be:

- New taxes are hugely unpopular with people generally refusing to believe that other taxes will be reduced as a consequence.

- Carbon taxes in one country will simply drive carbon intensive operations to places where there is no carbon tax.

- Measuring carbon dioxide emissions and collecting carbon taxes will be bureaucratic and inefficient.

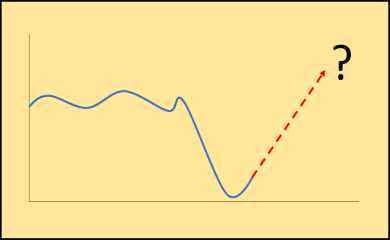

Are Carbon Taxes coming?

Organisations resisting climate change policies have historically included multinational Oil companies and the United States Republican party – the US being the world’s largest emitter of carbon dioxide.

This is changing. Both Oil companies (BP, Shell, Total, ExxonMobil) and US republican senators are advocating carbon taxes so that the US, and other major world economies, can reduce their carbon emissions through market mechanisms.

A group called the Climate Leadership Council, endorsed by more than 3,500 US economists, advocates a US system of carbon taxes. The full statement reads:

ECONOMISTS’ STATEMENT ON CARBON DIVIDENDS

Global climate change is a serious problem calling for immediate national action. Guided by sound economic principles, we are united in the following policy recommendations.

- A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary. By correcting a well-known market failure, a carbon tax will send a powerful price signal that harnesses the invisible hand of the marketplace to steer economic actors towards a low-carbon future.

- A carbon tax should increase every year until emissions reductions goals are met and be revenue neutral to avoid debates over the size of government. A consistently rising carbon price will encourage technological innovation and large-scale infrastructure development. It will also accelerate the diffusion of carbon-efficient goods and services.

- A sufficiently robust and gradually rising carbon tax will replace the need for various carbon regulations that are less efficient. Substituting a price signal for cumbersome regulations will promote economic growth and provide the regulatory certainty companies need for long- term investment in clean-energy alternatives.

- To prevent carbon leakage and to protect U.S. competitiveness, a border carbon adjustment system should be established. This system would enhance the competitiveness of American firms that are more energy-efficient than their global competitors. It would also create an incentive for other nations to adopt similar carbon pricing.

- To maximize the fairness and political viability of a rising carbon tax, all the revenue should be returned directly to U.S. citizens through equal lump-sum rebates. The majority of American families, including the most vulnerable, will benefit financially by receiving more in “carbon dividends” than they pay in increased energy prices.

Realistic Carbon Tax Rates

Carbon tax rates are usually expressed in US dollars per tonne of carbon dioxide. The figure cited by the Washington Post, Shell and BP is 40 US Dollars per tonne. In the current EU carbon trading scheme carbon dioxide emissions are being traded for approximately 25 Euros (27.50 USD) per tonne.

Conclusions

Carbon taxes are coming with a starting price of 40 US Dollars (£31) per tonne looking likely. In my view carbon taxes seem like an effective part of reducing man made climate change worldwide.

References

https://clcouncil.org/media/2017/03/The-Conservative-Case-for-Carbon-Dividends.pdf

https://clcouncil.org/economists-statement/.

Image accreditation: https://commons.wikimedia.org/wiki/File:DC-Climate-March-2017-1510585_(33551760463).jpg